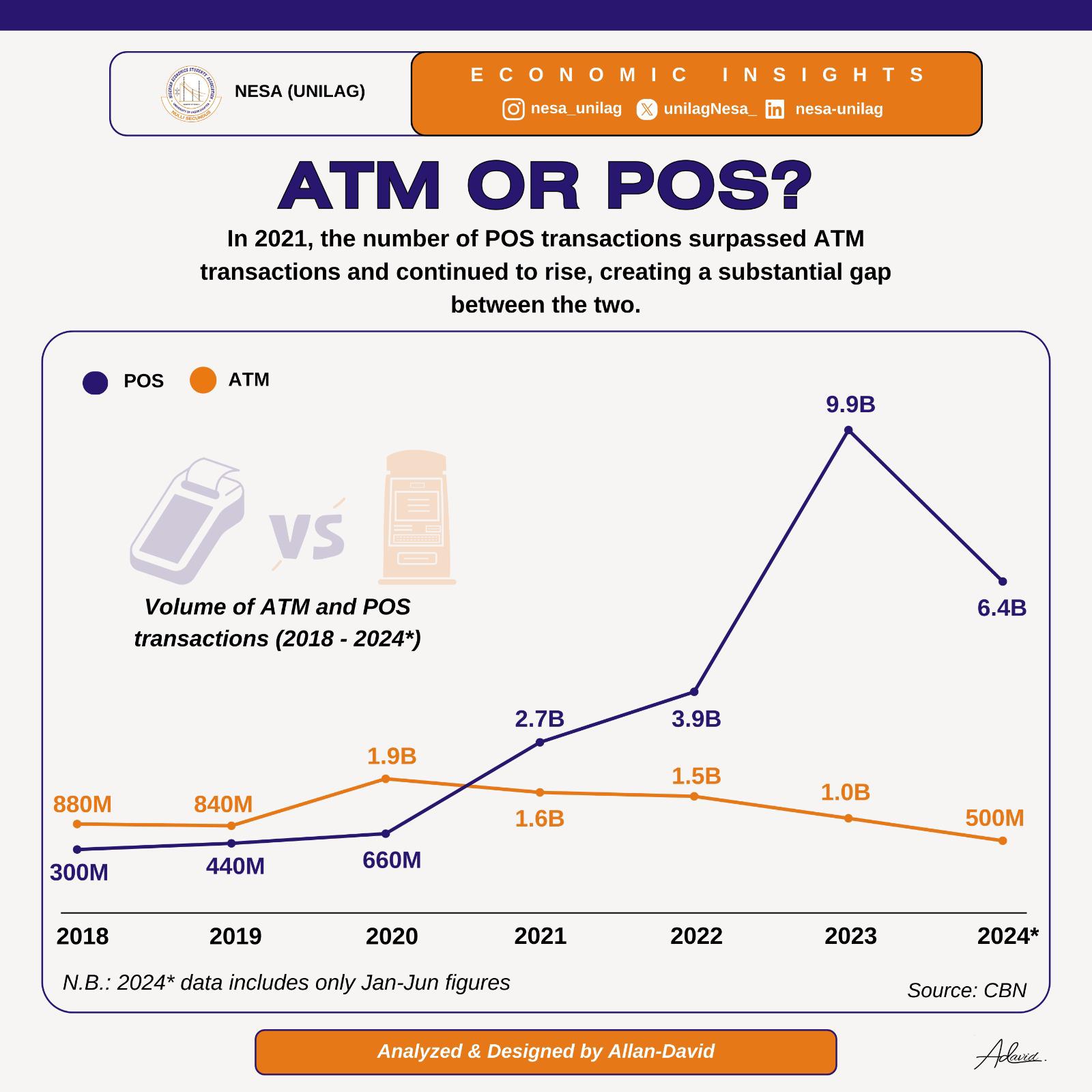

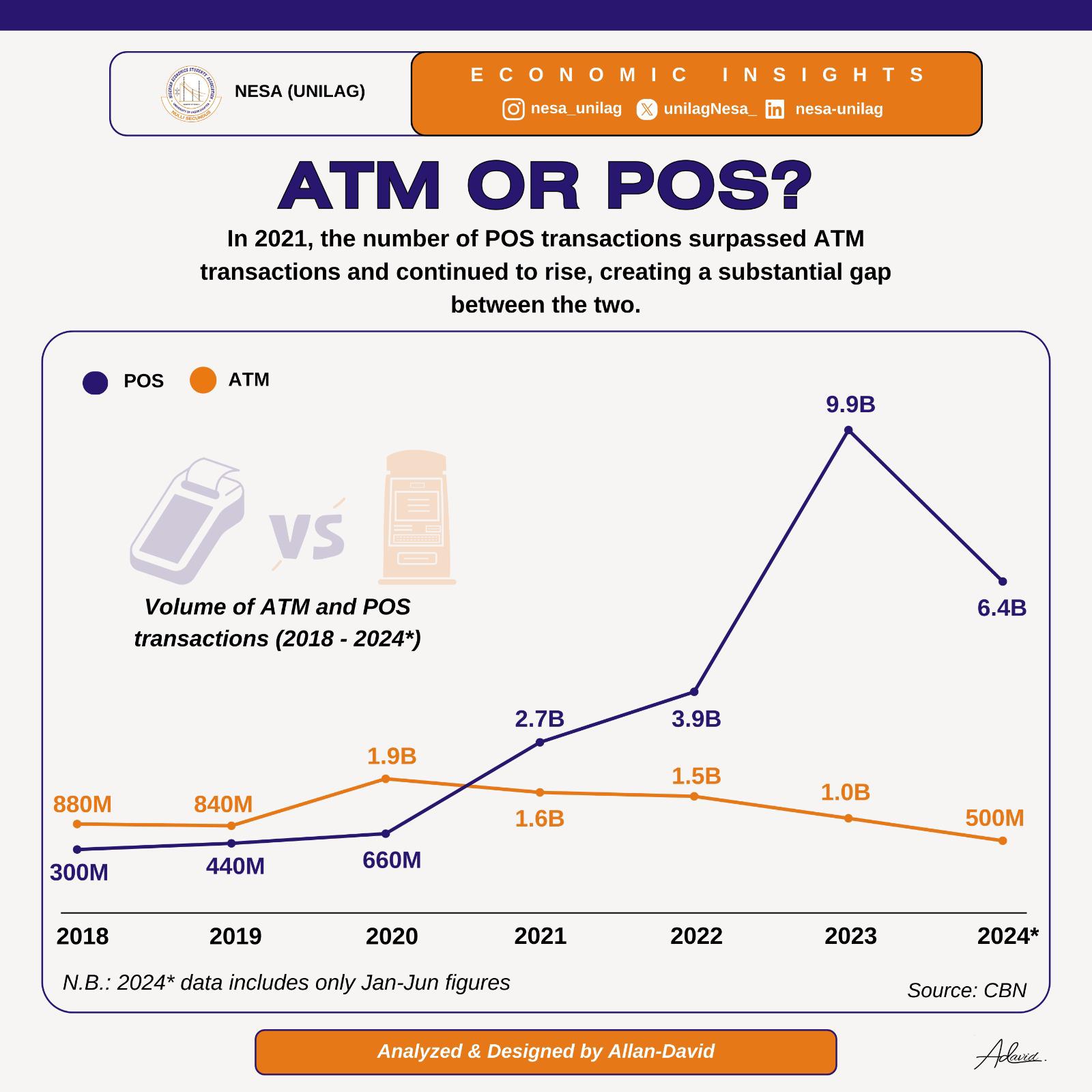

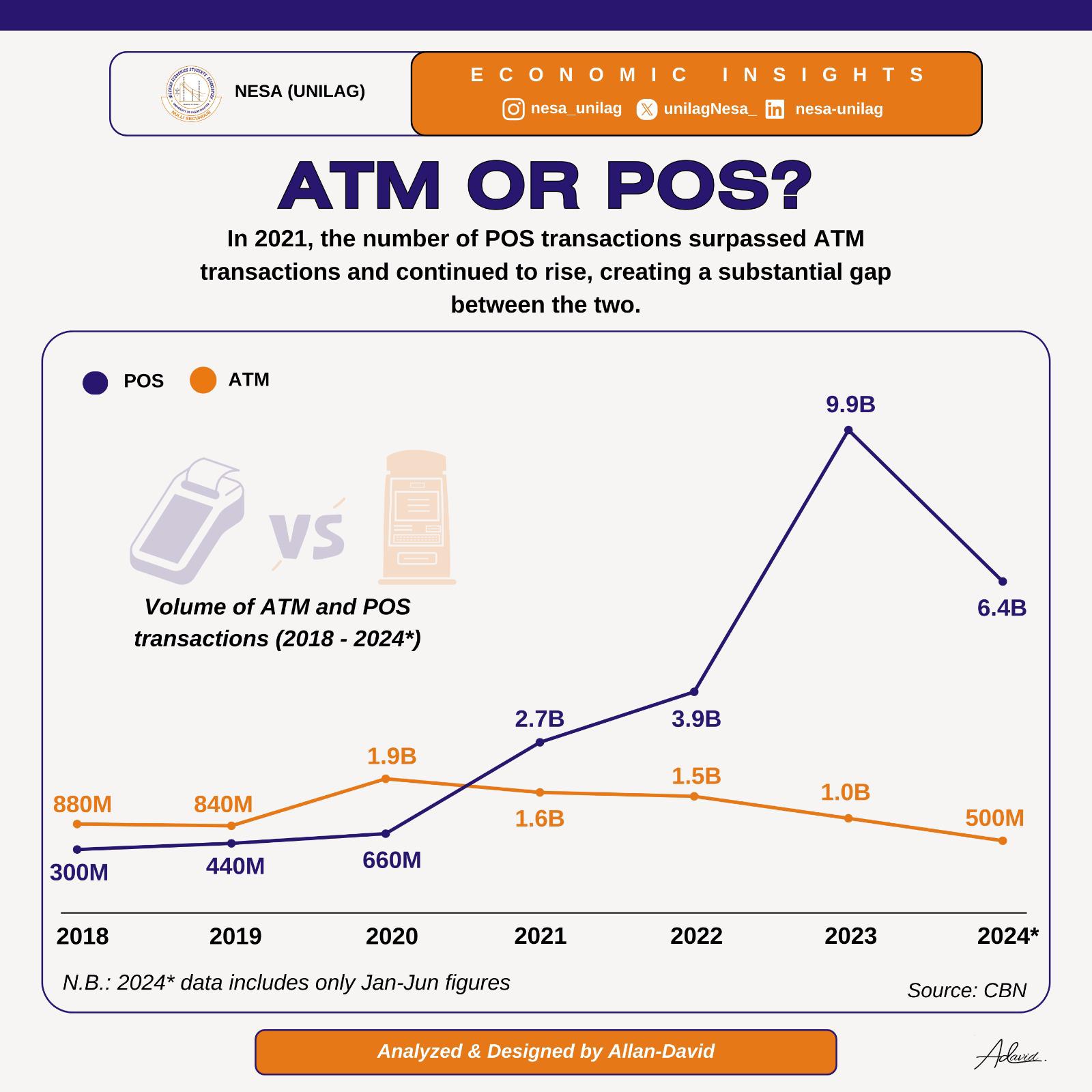

The way Nigerians make payments has changed significantly in recent years. According to data from the Central Bank of Nigeria (CBN), Point of sale (POS) transactions have not only surpassed traditional ATM (Automated teller Machine) withdrawals but now far exceed them in both volume and value, I.e the number of transactions completed and the total amount withdrawn. This highlights how technology is changing financial habits and driving the country toward a cashless economy.

In the first half of 2024, Nigerians spent an astonishing ₦85.91 trillion through POS systems, which is more than seven times the ₦12.21 trillion withdrawn from ATMs during the same period. The value of POS transactions increased by 77% compared to 2023, and the number of transactions rose by 31%, increasing from 4.87 billion to 6.39 billion.

In contrast, the number of ATM transactions has decreased. From January to June 2024, the volume of ATM withdrawals fell slightly, from 519.52 million in 2023 to 496.43 million in 2024, with transaction values declining by 16.6%.

The question is: Why are Nigerians using POS more than ATMs?

The increasing use of the POS systems is driven by several factors.

1. Convenience: POS terminals are now everywhere, markets, stores, restaurants, and even roadside shops. This widespread availability has made cashless payments quick and hassle-free.

2. Cash Scarcity: ATM queues can be a nightmare then Add it to the recent cash shortages, and you’ve got plenty of frustrated Nigerians. POS has become a reliable way to bypass these challenges.

3. Security: Carrying large amounts of cash comes with risks. By using POS you minimize the chances of theft or loss, making POS transactions a safer option.

While these are major reasons for using the POS, there are Other Digital Payment Methods also increasing that we should note, Mobile and internet banking. The Mobile and Internet Banking are also experiencing a rapid increase in transactions as more Nigerians turn to digital transactions. This shift indicates a wider acceptance of cashless solutions throughout the country.

Are cashless transactions sustainable in Nigeria now?

Big No, and here are my whys.

1. Network: Good and reliable internet access and even electricity are important to ensuring digital payments work smoothly everywhere, especially in rural areas and Nigeria is still lacking in this regard.

2. Cybersecurity: With more people using digital transactions, there is the need to protect users from fraud and data breaches is more important than ever. Nigeria is ranked 16th in the world for cybercrime victims.

3. Financial Inclusion: Millions of Nigerians still don’t have access to bank accounts, which makes it impossible for them to fully participate in a cashless economy.

Think about how far we have come. A few years ago, you’d need to withdraw cash from an ATM to shop at your local market. Now, you can simply swipe your card or pay with your phone. This not only makes transactions faster but also cuts down on the stress of sourcing physical cash.

As the use of POS continues to increase, it’s clear that Nigerians are accepting a new way of banking, one that’s more efficient and cashless.

The data doesn’t just show a shift in numbers, it also reflects a change in our lifestyle, financial decisions, shopping, and our view of money every day.

Are POS operators now the new bankers?

One could argue that these operators are becoming the face of everyday banking for many Nigerians.

What do you think? Let’s discuss in the comments.